Entering the 21st century, the World bank Group (WBG) combined support for poverty reduction and the achievement of the Millennium Development Goals (MDGs) with continued strategic focus on reform-oriented states.

International Finance Corporation(IFC ) worked with the regulator to launch offshore and onshore masala/maharaja bonds, build regulatory processes and a yield curve through a series of issuances to address lack of long-tenor, local-currency market instruments.

Through this instrument Indian entities accessed international capital markets without exposure to foreign exchange risks.

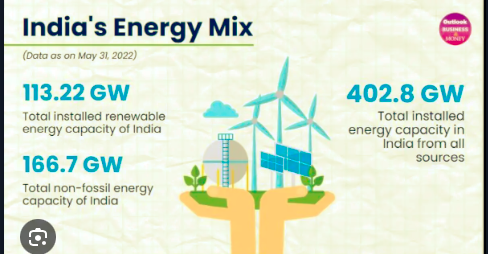

IFC has used a variety of products including PPP and advisory services, and innovative products such as green bonds and treasury tools. Finally, IFC and the World Bank have contributed to developing the renewables energy (RE) market in India.

IFC invested generation companies and financial intermediaries have contributed about 20% of the incremental renewable energy generation capacity in India over the last five years.

Deal Sourcing and structuring of Infrastructure investment opportunities.

Top 6 domains where developed nations apply mind

- Transportation .. connectivity to air & sea ports I inland waterways I bridges I E-public utilities

- Broadband & digital security . Blockchain governance I bridges

- Energy & Power. … electrical power production and transmission that facilitate green energy technology

- Water & reuse technologies .… saving and reuse equipping modernise technologies

- Education … universities I accessibility I global exchange programmes

- Environmental Remediation.. reclaim contaminated land I manage climate change I clean rivers

Under the World Bank Group’s Climate Change Action Plan (CCAP),, the world bank committed to increase climate finance target to 35% of total commitments over the next five years, align financing flows with the goals of the Paris Agreement, and achieve results that integrate climate and development. World Bank (IBRD/IDA) did zero new fossil fuel financing. and stopped investing in upstream oil and gas in 2019.”

Source I World Bank

Non Renewable

“Tapping the rooftop solar market will be essential for India to meet its massive energy needs. The country has a lot of catching up to do – its per capita consumption of electricity is less than one third the world average.”

I Simon Stolp I Lead energy specialist I World Bank

big data analysis

Author Sa. Venkat Ramanujan is a Certified Environment Social Framework Specialist of Word Bank Group and also Certified Independent Director of IICA, Ministry of Corporate affairs , Govt of India.

He is Member of Institute of Directors & All India Management Academy ( AIMA ),

He is Founder & CEO of Trust Infosys Incorporation – Govt. of India accredited startup venture, A distinction holder in his Post graduate MBA studies and a sustained learner for three decades in the domains of engineering & infrastructure projects , international trade & contracts , data & cloud management , environmental, social & corporate governance.,

Environmentalist, Voracious Reader, Interested in Cats and Dogs, Love Gardening, Reuse & Recycler of Natural Resources,

for more details check in >> venkatramanujam.in